Moving the needle from subsistence to growth for home-based businesses

Photo: Ria Dutta

This article presents insights from a study on understanding the state of market access and enterprise readiness among women entrepreneurs in the handicrafts and handlooms sectors. The study was conducted across Tamil Nadu and Rajasthan.

Within a 45-minute ride from Jaipur, lies a small village Chomu. Dotted with countless independent looms and community workshops operated by women, the village is a vivid representation of rural India’s cottage industry. Workshops set up by private companies and Self-Help Groups (SHGs) become places for skill training and a source of livelihood for these homepreneurs. This practice has enabled craft clusters to develop organically in small pockets across Rajasthan.

Rajasthan is not the only state with a thriving cottage sector. Small pockets like Chomu can be found all across India. Tamil Nadu is one such example and leads the way in the handloom sector. Tamil Nadu Corporation for Development of Women under the Ministry of Rural Development plays an instrumental role in capacity building and streamlining efforts of home-based entrepreneurs.

The Manufacturing sector is the second highest contributor to the Gross State Domestic Product (GSDP) for both Rajasthan and Tamil Nadu. According to WIEGO, 23% of non-agricultural workers in India are home-based entrepreneurs, of which an overwhelming 67% are women. To understand the barriers faced by this vast and diverse segment of women-led home based businesses (HBB), we conducted a mixed methods study which explored market access and enterprise readiness of 800 women entrepreneurs across Rajasthan and Tamil Nadu in the handloom and handicraft sectors. This article highlights the ecosystem and market constraints faced by women led HBBs in the cottage industry.

Dual burden dictates choices

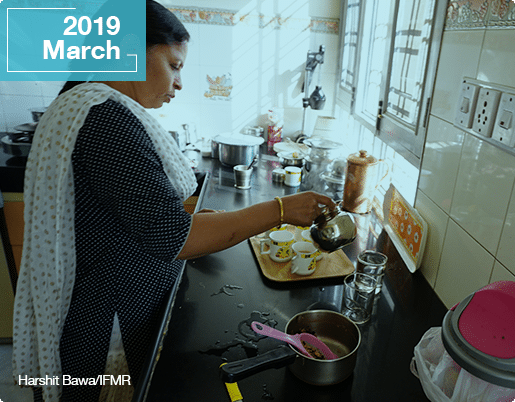

Women entrepreneurs are often marriage migrants and are likely to move with their husbands. They work from their home premises or workshops on adjacent grounds and shuttle between domestic care duties and their business. Home-based work is rooted in the social preference for married women to work from home so that they can take care of their household responsibilities such as cooking, cleaning, fetching water, looking after their children and so on.

On the flipside, working from home without formal or standard employment contracts reduces their means to assert their rights as entrepreneurs under labour laws. Only 37.4% women in our study had businesses registered under their own name, which suggests that a significant majority of businesses remain outside the purview of formal labour laws, rendering them invisible. Organisations such as SEWA Bharat and other bunkar sansthas (weaver collectives) are playing an important role in enabling women engaged in informal enterprises. Mobility and time limitations along with the dual burden of balancing business and caregiving priorities determine women’s preferences for working from their homes and linking with aggregators. Our study found that women are able to dedicate only 5.8 hours a day on average to their home-based business, which is intermittently interrupted by 6.6 hours of unpaid caregiving work.

The sectoral landscape in Rajasthan is dominated by private players and SHGs, whose business models align with women entrepreneurs’ need for flexibility in the workplace. Affiliation with contractual companies reduces monetary burden/investment, time, and effort of procuring raw materials and selling products. On the other hand, in Tamil Nadu the state acts as a key enabler and facilitator for homepreneurs engaged in the handloom and handicraft sectors. The state government is the nodal agency overseeing the Cooperative Societies that help weavers organise themselves and facilitate optimal market outcomes.

Weak bargaining power

Individual artisans who are classified by the National Sample Survey Office (NSSO) as own-account entrepreneurs are expected to bear the risk and cost of production and scout for potential markets independently as per their work arrangements. Own-account entrepreneurs are concentrated in the handicraft sector since the sector has not been equally capitalised by market players in comparison to the handloom sector in both states. Typically, own- account entrepreneurs have low bargaining power in both procurement and selling activities (Women, Gender and Work, V2, ILO (2017)).These women are in charge of the entire supply chain from buying raw materials to selling it in the market.

The second category is piece-rate entrepreneurs who work with aggregators and private companies. These companies promote doorstep entrepreneurship by providing all raw materials and taking finished products from their home premises. According to NSSO, piece-rate entrepreneurs are ‘subcontracted workers’, who are not classified as ‘employees’ within the standard employment relations or rights and are clubbed with Own-Account enterprises (OAEs) under self-employment. Such a classification results in loss of access to associated rights and makes OAEs invisible.

70% of women entrepreneurs in our study were associated with aggregators and private companies. These overarching institutions monetised on the artisanal and weaving skills of these entrepreneurs and drew a larger portion of profits. However, entrepreneurs indicated a strong preference to work with aggregators, since these institutions enable access to regular supply of raw materials and a market for finished products. This restricts and binds the women homepreneurs to a single operator and limits their scalability. Women lose bargaining powers and this leads them to be a price-taker.

Respondents in our study however did not mind losing the bargaining power, and spoke in terms of respect and gratitude for the contractor for providing them work. Rather than negotiating for better profit margins, they rely on requesting the contractors for more work. The contractors themselves are marginal players in long and opaque supply chains with little power –their strength lies in remaining competitive and offering the cheapest options for products in the market. They have limited information about where their product would be sold, and no means to hold the retailer accountable (IndiaSpend, 2020).

Closed communication channels

90% of entrepreneurs surveyed in Rajasthan and over 60% of those interviewed in Tamil Nadu worked in a closed communication channel by running piece-rate businesses associated with SHGs/ aggregators. Only 5% of the 800 surveyed women tried to diversify their customer base once they adopted a piece-rate business model. While working with aggregators or private companies has enabled consistent market access for their finished products, the associated closed communication channel with it led to a loss in independent decision-making, market access and sector awareness. We found that the uptake of government schemes like MUDRA loans, which is targeted towards women entrepreneurs was as low as 3.5% in our sample. Heavy reliance on aggregators for business related communication and an absence of an alternative source of information is one of the reasons for a low uptake of schemes.

Resistance to switch to alternative payment methods like use of mobile wallets was observed across the board. 98% business related payments were made in cash on a weekly or monthly basis. Merely 0.2% of the surveyed entrepreneurs used an online platform to communicate business related information to customers.

Suman who works on looms with Jaipur Rugs in Tigariya village is hesitant to conduct business on online platforms and says:

“If you can put a face on the customer I can sell my products. I like to sell my rugs to people who I know. I have been working with the company for two decades and I am comfortable dealing with them since I know they mean well for me. ”

Often, women are compelled to involve their children to complete their orders on time during festival seasons such as Navratri or Diwali. Work is plenty and even friends and neighbors are called in to help for a share of the earnings. For the aggregator or retailer, the cost of production remains the same but for the home-based workers, incomes are further depleted despite the long working hours.

Tool for Measuring Market Readiness

Gauging business readiness in the informal sector is the key to enable policy support in terms of identifying best practices, creating market linkages, and targeting skilling initiatives as it directly links to enterprise performance. Based on insights from the study, we have developed a diagnostic tool –‘Women Business Readiness Scorecard’ to identify barriers faced by women entrepreneurs and target policy and program interventions better. The tool consists of four sub- indices- agency, market readiness, product readiness and legal & regulatory readiness.

Based on the entrepreneur profiles that emerged from our primary dataset, we have identified three customer archetypes or personas of women engaged in home-based businesses: millennial entrepreneurs, striving entrepreneurs, and latent entrepreneurs. These personas are based on the age, entrepreneurial and risk-taking abilities of entrepreneurs.

Based on the entrepreneur profiles that emerged from our primary dataset, we have identified three customer archetypes or personas of women engaged in home-based businesses: millennial entrepreneurs, striving entrepreneurs, and latent entrepreneurs. These personas are based on the age, entrepreneurial and risk-taking abilities of entrepreneurs.

Jayamani from Coimbatore is an example of a striving entrepreneur:

“Jayamani has been weaving Kovai cotton-silk (Korapattu) for 30 years now and gets raw materials from and sells back finished sarees only to the Weavers Cooperative Society. She is capable of weaving more but is limited by demand/orders she received from the Cooperative. Jayamani feels she has financial constraints that stop her from expanding her business.”

Restrictions on freedom of movement have significant effects on the likelihood of women becoming ‘high aspiration entrepreneurs.’ It is essential to look beyond adopting a single approach to identify enterprises with growth potential. The Business Readiness Scorecard for Women, developed by IWWAGE and LEAD at Krea University, is a step in this direction.

The informal nature of home-based businesses in handloom and handicraft sectors makes it possible for contracting companies to reduce their costs. These sectors provide women alternative livelihood opportunities that confirm with existing social and cultural norms. The companies lower overheads and limit the market accessibility of the entrepreneurs. Our hope is that the Women Business Readiness Scorecard and the entrepreneur archetypes that emerged from our study will provide policymakers and practitioners a framework for targeting enterprise development initiatives.

Ria Dutta is a Research Associate with LEAD at Krea University.

- Posted In:

- Latest Blogs

Leave a Reply